Targeting HER3 – a little wave of drug development that’s about to get a lot bigger

A post-ASCO update on tumor targets DLL3, B7H3 and HER3

July 2025

Paul D Rennert, SugarCone Biotech LLC

Introduction: DLL3, B7H3 and HER3 are compelling tumor antigens to target with cancer therapeutics. They have interesting patterns of expression in different cancer indications; thus, diverse therapies for attacking these targets have been developed. Each target and each therapeutic modality induces varying degrees of clinical efficacy, as well as causing toxicities. Importantly, effective combinatorial approaches that include these targets are emerging. Finally, while there are clear front runners among the pharmaceutical companies developing targeted therapeutics for these antigens there are also emerging biotechs aggressively pursuing these targets. The result is a complex clinical, commercial and competitive landscape.

HER3 is a member of a cell surface receptor family that includes EGFR and HER2, growth factor receptors that deliver proliferation and survival signals to cells and are therefore used by various cancers. HER3 plays a pivotal role in activating downstream signaling pathways through heterodimerization with other receptors like HER2 and can mediate resistance to therapies targeting EGFR and HER2, making it a compelling target for novel treatments in cancers that rely on oncogenic signaling via those related growth factor receptors. HER3 is also responsible for oncogenic signaling through it’s abnormal gene activation due to a cancer-causing genetic phenomenon called a NRG1 gene fusion. NRG1 fusions result in aberrant expression of the NRG1 EGF-like domain on the cell surface which serves as a ligand for HER3 and induces the formation of HER2-HER3 heterodimers. These activities are pro-oncogenic (reviewed here: https://pmc.ncbi.nlm.nih.gov/articles/PMC8911318/#R15).

It follows that HER3-targeting therapies have emerged as a class of anti-cancer treatments designed to treat various tumors that have developed resistance to EGFR or HER2-directed therapies or have emerged due to a NRG1 gene fusion. This is an active drug development landscape with a lot of recent news.

The leading program is the approved therapeutic zenocutuzumab developed by Merus N.V. Zenocutuzumab is a full-length IgG1 bispecific antibody that binds HER2 and blocks HER2-HER3 dimerization and blocks NRG1 EGF-like domain from interacting with HER3 thereby suppressing tumor cell growth and survival. Zenocutuzumab also has enhanced antibody-dependent cellular cytoxicity (ADCC) activity that directly kills the targeted tumor cell. This drug received accelerated approval in December 2024 for pancreatic cancer and non-small-cell lung cancers (NSCLC) carrying NRG1 gene fusions, only 11 years after the first NRG1 gene fusion paper was published (https://doi.org/10.1158/2159-8290.CD-13-0633). The approval was based on a small Phase 1/2 study run by the MSKCC and collaborators. Patients with 12 types of NRG1 fusion-positive tumors were treated. The response rate was 30% and the median duration of response was 11.1 months (see https://www.nejm.org/doi/full/10.1056/NEJMoa2405008). These results are notable given the poor response of NRG1 fusion driven cancers to chemo- and immuno-therapies.

Reporting in Nature Reviews Drug Discovery, @AsherMullard noted that Merus must provide the FDA with confirmatory evidence of benefit in both NSCLC and pancreatic adenocarcinoma in order to achieve full approval and that analysts predict annual sales of around $180 million by 2030 per consensus forecast via Cortellis. On this basis, and to drive use of the RNA sequencing technology that identifies NRG1 fusions, the drug was purchased by Partner Therapeutics. Of course the larger markets would be in non-NRG1 fusion cancers where HER3 is overrexpressed but Partner Therapeutics does not appear to be supporting additional clinical trials.

This is where the rest of the drug development field comes in. Leading this space are the antibody-drug conjugates, both monospecific (anti-HER3 antibodies) and bispecific (anti-HER3/anti-X, where X + a second tumor-expressed target). I’ve also included “naked” antibodies and bispecific antibodies – these rely on ADCC-cytolytic activity, as just described for zenocutuzumab.

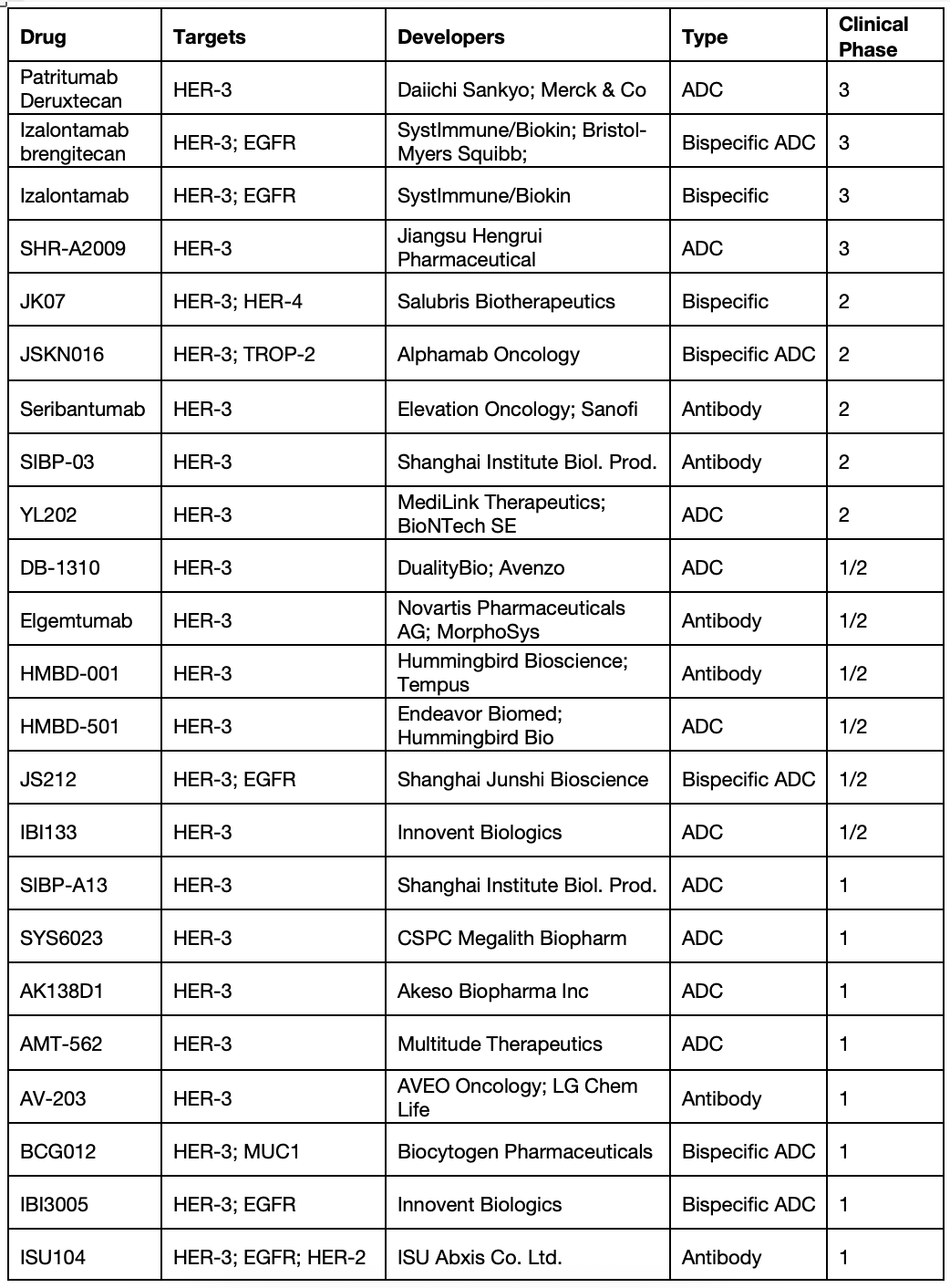

Let’s have a look, just at the clinical stage programs:

(Table sourced from Beacon Intelligence)

There are also at least 40 preclinical programs.

The leading clinical program had been the ADC patritumab deruxtecan (HER3-DXd) targeting HER3 and carrying a topoisomerase I inhibitor payload (Topo1i, the drug conjugate) attached using a cleavable linker. Once bound to HER3-expressing tumor cells, the ADC is designed to be internalized and the cytotoxic payload released to induce DNA damage and cell death. This drug, from the powerhouse collaboration between Merck and Daiichi Sankyo, was driving toward accelerated approval in patients with EGFR-mutated NSCLC who had progressed on combination EGFR inhibition and chemotherapy based on promising Phase 1 and Phase 2 progression-free survival results. However, HER3-DXd missed achieving a statistically significant improvement in overall survival, leading to the withdrawal of its U.S. regulatory application in NSCLC. Drug development has also been hampered by serious adverse events, including Grade 3 or higher levels of neutropenia and interstitial lung disease. The sponsors continue to trial HER3-DXd broadly in breast cancers, gastrointestinal cancers, NRG1 fusion associated cancers and other solid tumors (https://clinicaltrials.gov/search?intr=patritumab%20deruxtecan%20).

The broader field continues to advance, notably with the bispecific izalontamab brengitecan, aka iza-bren, that targets HER3 and EGFR. Iza-bren is a topo1i-linked ADC that addresses a simple clinical hypothesis: that HER3 and EGFR are coexpressed on solid tumor cells. A recent study showed intermediate to high prevalence of EGFR and HER3 co-expression in lung cancers, triple negative breast cancer (TNBC), biliary tract cancers (BTC), and nasopharyngeal carcinomas (NPC). Further, co-expression of EGFR and HER3 in normal human tissues was found to be rare and faint (see https://doi.org/10.1158/1538-7445.AM2024-6190). This suggests that bispecific targeting of EGFR and HER3 would bias drug delivery to the brightly expressing cancer cells, with limited normal tissue toxicity. Bristol Myers Squibb (BMS) licensed rights to iza-bren in 2023 and they and partner Sysimmune/Biokin have sponsored clinical studies across cancer indications without limiting these to settings of EGFR resistance or of NRG1 fusion. This is why their simple clinical hypothesis is critical – they can target the HER3/EGFR expression pattern, as well as the underlying cancer biology. Promising response rates have been seen in NSCLC, NPC, urothelial carcinoma and breast cancers; some programs were recently updated (ASCO 2025). Safety data have been good, with Grade 3+ toxicities limited to cytopenias, including neutropenia (grade 3+ = 34%) and thrombocytopenia (grade 3+ = 19%). Clinical development is extensive, as detailed by @ByMadeleineA at ApexOnco (https://www.oncologypipeline.com/apexonco/systimmune-spreads-first-line-lung; https://www.oncologypipeline.com/apexonco/bristol-goes-pivotal-systimmune-partnered-conjugate). Most recently, BMS began a Phase 1/2 clinical trial of iza-bren in combination with the mutant-EGFR inhibitor osimertinib or with the PD-1 anti-antibody pembrolizumab in advanced solid tumours and Biokin reported that iza-bren hit it’s primary endpoints in a Phase 3 trial for advanced NPC (https://firstwordpharma.com/story/5977722). This will lead to near-term approval in NPC.

Such progress is driving extensive drug development, as seen in the table above that includes HER3 ADCs from Jiangsu Hengrui, Duality Bio and many others, the novel HER3/TROP2 bispecific ADC from Alphamab Oncology, the HER3/HER4 bispecific antibody from Salubris Biotherapeutics, and additional large biopharma collaborations (Novartis, Sanofi, BioNTech). It is worth noting that several biopharma anti-HER3 antibody programs failed in clinic due to poor efficacy/toxicity profiles (Lumretuzumab from Roche, GSK2849330 from GSK). This suggests that each program listed above may face challenges as they advance clinically. Certainly the space is crowded; winners and losers will emerge.

Stay tuned.